Last month we speculated that the end of the summer vacation period could herald a positive step change in public transport usage, with the return to office working en masse potentially starting to pick up pace.

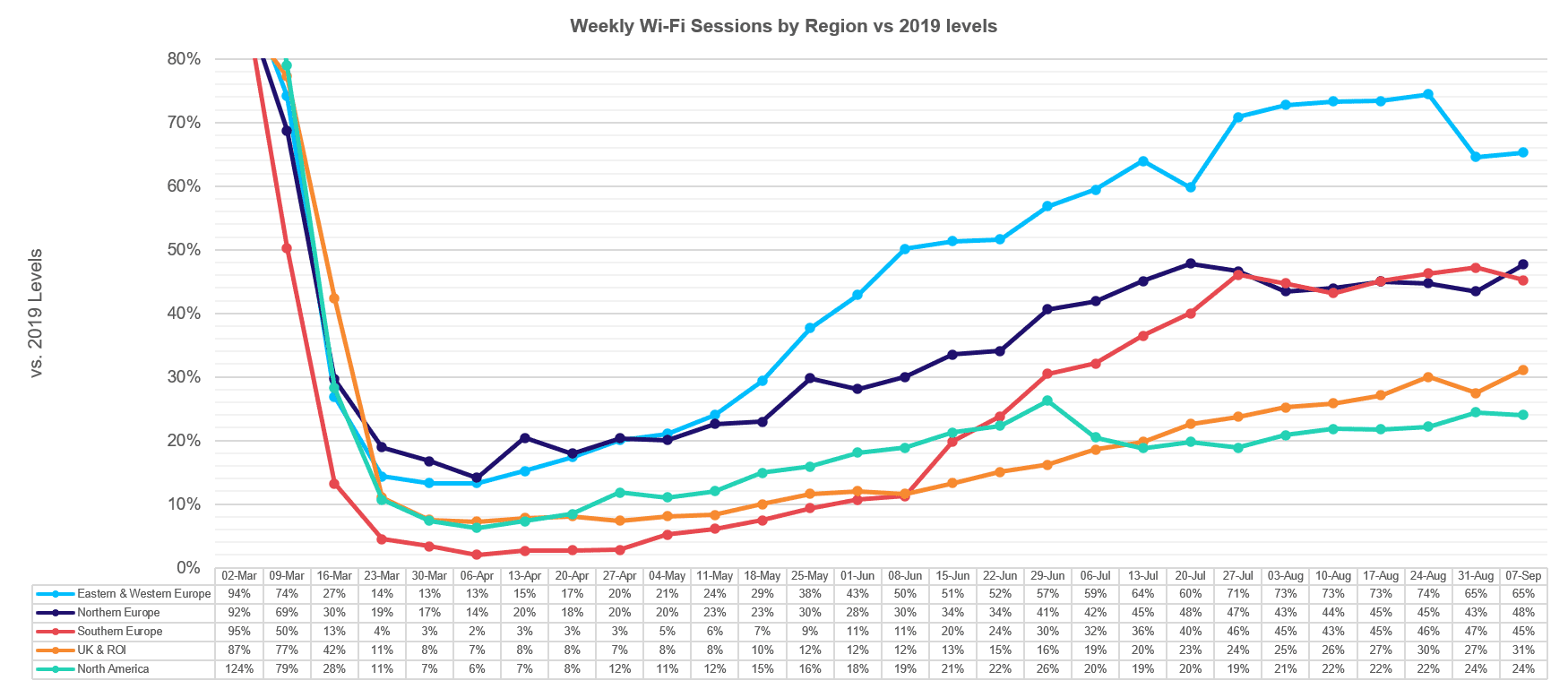

Now, midway through September, Icomera has released the latest Passenger Wi-Fi usage levels from 30,000+ trains, trams, buses, and coaches operating across Europe and North America. When tracked as a percentage of 2019 usage levels, weekly Wi-Fi usage gives a reliable indication of public transport’s rate of recovery as COVID-19 restrictions are assessed.

This latest update shows that the strength and consistency of the recovery remains unclear and vulnerable to new localised spikes in COVID-19.

(View full resolution here)

All regions experienced a dramatic drop in weekly Passenger Wi-Fi usage through March, reaching their respective low points between late March and late April. While all regions clearly felt the impact, the session volume data illustrates that some fell further than others and, as the world emerged from the crisis, the subsequent recovery rates varied.

- Eastern and Western Europe are currently showing a +52 percentage point recovery from the lowest point (13%), to now sit at 65% of 2019 levels. Having demonstrated the strongest recovery from mid April through to the end of July, Passenger Wi-Fi usage in these regions recovered at a slower rate through August before suffering a -10p.p. setback at the start of September. This coincided with a surge in coronavirus cases and the implementation of new localised lockdowns.

- Northern Europe (excluding the UK and Republic of Ireland) is up 34p.p. to 48%. Like Eastern and Western Europe, the gradual recovery made from the low point in April plateaued over the summer, as recovery efforts were interrupted by the vacation period and less international travel hurting tourism. The +4p.p. uptick seen last week is the largest weekly improvement seen in the region since late June/early July. It may signal the restart of the recovery as more workers return to the office, but it is too early to say for sure.

- Southern Europe, up 43p.p to 45%, is now experiencing a similar recovery to Northern Europe, albeit from a comparatively weaker starting position. Like Northern Europe, the recovery slowed significantly over the summer. The -2p.p. setback seen in the last week came after the previous week’s post-lockdown high point.

- In the United Kingdom and the Republic of Ireland, Passenger Wi-Fi usage levels are now up 24p.p. to 31% of 2019 levels. Government advice on avoiding public transport was relaxed at the start of August and the +6p.p. recovery seen since then is greater than any other region has experienced in the same period.

- North America is up 18p.p. from its low point, to 24%. Although it has still not fully recovered from a -6p.p. setback in early July (11 weeks ago), North America saw an increase in Wi-Fi usage in five of the last six weeks. Only the United Kingdom and the Republic of Ireland matched this in the same period.

Outside of the successful development and widespread distribution of a vaccine, there is currently no obvious reason to believe any external factors will trigger a significant increase in public transport’s rate of recovery in the near future.

Instead the industry must drive its own recovery and Icomera believes that technological innovation and intelligence based on fast access to data will be key. As the world’s leading provider of mobile Internet connectivity for public transport, we have long recognised the value of reliably and securely transmitting data to and from vehicles, either streaming it in real-time or offloading it on-demand. Fast and appropriate responses based on this data will be essential for protecting passengers and controlling the spread of this virus, or any future pandemic.

Icomera is positioned to take a leading role in the industry’s Internet-enabled recovery plan and ultimately shift society’s travel habits back towards sustainable, green mobility.

If you’re interested in following our progress, please consider subscribing to our mailing list.